To Loan Or Not To Loan

You see, I already owned a private property when the SERS was announced. Hence I do not qualify for any HDB loan when comes to the new SERS BTO.

HDB Loan Eligibility Criteria

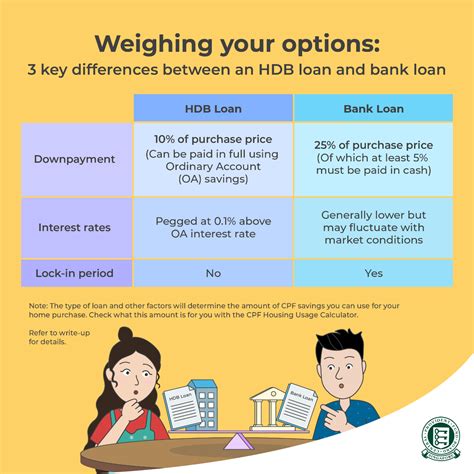

The HDB loan, also known as the HDB Concessionary Loan, is a housing loan provided by the HDB at a concessionary interest rate. This loan is available to eligible Singapore Citizens and Permanent Residents for the purchase of an HDB flat.

One of the key eligibility criteria for an HDB loan is that the applicant, their spouse, or any occupiers listed in the flat application must not own, dispose of, or have an estate or interest in any other flat, house, building or land*. This includes private residential property, both locally and overseas, within 30 months before the date of the new HDB flat application, and up to the date of taking possession of the new HDB flat.

A Tale of Full Payment: Bypassing the Paperwork for a New HDB Home

In the bustling city-state of Singapore, the dream of owning an HDB flat is one that many of us share. But for me, the journey to this dream was a little different. I decided to pay in full for my new HDB home, bypassing the option of taking any loans. You might wonder why. The answer is simple: I wanted to avoid the mountain of paperwork that comes with loan applications.

The decision wasn’t made on a whim. It was a carefully considered choice, born out of my previous experiences. I had purchased a private property in the past, and the process of securing a loan was a tedious one. The endless forms to fill out, the numerous documents to provide, the constant back-and-forth with the bank – it was a time-consuming and stressful process.

When the opportunity arose to purchase an HDB flat, I was determined to do things differently. I had been saving diligently over the years, and I had enough to cover the cost of the flat. Paying in full would mean bypassing the loan process entirely. No more paperwork, no more waiting for loan approval, no more interest payments. It was a straightforward transaction – I pay the money, I get the keys to my new home.

The decision also gave me a sense of freedom. Without a loan hanging over my head, I felt a sense of financial independence. I was not tied down by monthly repayments, and I had the flexibility to manage my finances as I saw fit. It was a liberating feeling.

Of course, this path may not be suitable for everyone. It requires a significant amount of savings, and it means tying up a large sum of money in your home. But for me, the benefits outweighed the drawbacks. The peace of mind that came with owning my home outright, free from any debt, was priceless.

A Journey Towards Semi-Retirement: A Debt-Free Life Amid Rising Costs

As I approached the age of 55, the prospect of semi-retirement loomed on the horizon. It was a milestone I had been eagerly anticipating, and one that I had prepared for meticulously. The decision to pay in full for my HDB home years ago was a crucial part of this preparation. It meant that as I transitioned into semi-retirement, I would do so without the burden of housing debt.

In the face of rising costs and an increase in Goods and Services Tax (GST) (thanks to the current government), this decision proved to be even more beneficial. Without a monthly mortgage repayment, I had more financial flexibility. I could allocate my resources more effectively, prioritizing essential expenses and investing in areas that would provide a steady income during my semi-retirement.

The absence of housing debt also provided a sense of security. With the cost of living on the rise, many of my peers found themselves grappling with financial stress despite looking grand on the physical surface. But for me, ‘owning’ my home outright meant one less thing to worry about. It was a sanctuary, a place of stability amid the uncertainty.

As I embarked on my semi-retirement journey, I found myself with more time to pursue my passions. I could travel, spend time with my loved ones, and additional funds for investment and generate more $$$. The freedom that came with being debt-free opened up a world of possibilities.

But perhaps the most significant impact was on my peace of mind. Knowing that I had a secure place to call home, regardless of the economic climate, gave me a sense of tranquility. It was a reminder of the wise decisions I had made in the past and the secure future they had enabled.