The decision to pay off a Housing & Development Board (HDB) loan ahead of schedule is a significant one for any Singaporean household. In the economic climate of May 2025, characterized by cautious growth and evolving interest rate landscapes, this choice requires careful consideration. This guide aims to dissect the pros and cons of early HDB loan repayment, offering tailored perspectives for different demographic groups, all while navigating the prevailing financial environment.

I. The 2025 Financial Landscape: Setting the Scene for Your HDB Decision

Understanding the broader economic and housing market conditions is paramount before delving into personal financial strategies. The Singaporean economy in May 2025 presents a mixed picture, influencing how one might approach a major commitment like an HDB loan.

A. Singapore’s Economic Pulse: Growth, Inflation, and Interest Rates in May 2025

Singapore’s economic trajectory for 2025 has seen some adjustments. The Ministry of Trade and Industry (MTI) has revised the nation’s Gross Domestic Product (GDP) growth forecast for 2025 downwards to a range of “0.0 to 2.0 per cent”. This is a noticeable deceleration from the 4.4% growth achieved in 2024 and reflects a challenging global environment, significantly impacted by factors such as the US-China tariff war. While the first quarter of 2025 registered a year-on-year GDP growth of 3.8%, a quarter-on-quarter contraction of 0.8% signals a weakening momentum as the year progresses. This economic slowdown, with some economists even warning of a possible technical recession in 2025, forms a critical backdrop for decisions involving large financial outlays or changes in debt structure.

Inflation, while having eased from previous highs, remains a tangible factor. The Monetary Authority of Singapore (MAS) projects core inflation to average between 1.0% and 2.0% in 2025, with the Consumer Price Index (CPI)-All Items inflation anticipated to be between 1.5% and 2.5%. However, public perception of inflation can sometimes differ from official figures. Surveys in early 2025 indicated that one-year-ahead headline inflation expectations among consumers were around 3.8%, with some metrics suggesting even 5%. This “felt” inflation, particularly concerning essentials like food, transport, and housing utilities can exert considerable pressure on household budgets and influence spending and saving habits more directly than official forecasts.

In response to easing inflation and mounting risks to economic growth, MAS has subtly adjusted its monetary policy, reducing the pace of the Singapore dollar nominal effective exchange rate (S$NEER) appreciation. While domestic interest rates have retreated from their peaks in late 2023, they are generally expected to stay above the ultra-low levels seen over the past decade. This environment means that borrowing costs, in general, remain relevant, although the HDB concessionary loan rate has maintained its stability.

The confluence of downgraded GDP forecasts and the potential for a technical recession points towards increased uncertainty in the job market and potentially slower wage growth. In such an environment, the importance of maintaining liquid assets, such as cash and emergency funds, becomes more pronounced than during periods of robust economic expansion. When individuals perceive their financial future as less secure, their preference for liquidity typically rises as a precautionary measure. This heightened need for a financial safety net can make large, illiquid commitments, like aggressive mortgage prepayments, less attractive, even if there are potential interest savings. The psychological impact of economic uncertainty may also lead individuals to become more risk-averse in their financial dealings.

Furthermore, if the public’s perception of inflation remains elevated despite official figures showing an easing trend, individuals might feel a greater squeeze on their disposable income. This could, in turn, reduce their capacity for discretionary financial actions like aggressive loan prepayments, regardless of their desire to do so. Consumer behavior is often shaped more by perceived economic conditions than by statistical data alone. If daily living costs feel as though they are rising sharply, households may prioritize managing essential expenditures, leading to a curtailment of non-essential financial moves, including extra mortgage payments.

B. The Housing Market: What’s Happening with HDB Prices in May 2025?

The HDB resale market has demonstrated continued resilience. In the first quarter of 2025, the HDB Resale Price Index (RPI) saw an increase of 1.6% compared to the fourth quarter of 2024, marking the 23rd consecutive quarter of price growth. However, this rate of increase is more moderate than the 2.6% growth observed in the preceding quarter, suggesting a potential cooling in the pace of appreciation.

Looking ahead, analysts project that HDB resale price growth for the entirety of 2025 will likely fall within the range of 3% to 6%. This represents a slowdown compared to the more rapid increases seen in previous years. Several factors contribute to this outlook. The government is actively increasing the supply of new flats, with approximately 19,600 Build-To-Order (BTO) flats slated for launch in 2025. Additionally, more resale flats are expected to enter the market as they reach their Minimum Occupation Period (MOP). However, the number of flats reaching MOP in 2025 is notably lower, at 6,974 units, an 11-year low, before a substantial increase is anticipated in 2026 (13,500 units) and 2028 (19,500 units).

In parallel, the private property market also shows signs of continued, albeit moderate, growth, with prices forecast to rise by 3% to 4% in 2025, driven by constrained supply and resilient demand.

For existing HDB homeowners, the moderating yet still positive price growth indicates that their property generally remains a significant and appreciating asset. However, the increased supply of BTO and Sale of Balance Flats (SBF) units, coupled with the anticipated surge in MOP flats in the coming years, could temper expectations of rapid price gains in the resale market. This dynamic might reduce any perceived urgency to “lock in” gains by quickly becoming debt-free if the capital used for prepayment could be deployed for other opportunities. While past price growth has built equity for many homeowners, the outlook for future growth is more subdued. An increased supply of housing typically exerts downward pressure on prices or slows the rate of appreciation. If an asset is not appreciating as rapidly, the opportunity cost of tying up capital in it—by prepaying the loan—versus investing that capital elsewhere becomes a more critical calculation.

The relatively lower number of MOP flats entering the market in 2025 specifically could mean less competition in certain segments of the resale market for that year, potentially offering some support to prices for those particular flat types. However, discerning buyers are often aware of future supply pipelines, including the larger MOP supply expected in 2026 and 2028. This foresight could influence their willingness to pay peak prices in 2025, which, in turn, indirectly affects existing owners’ decisions on whether to sell (and thus the need to clear the loan) or to hold onto their property. If an owner decides to hold, the question of whether to prepay the loan becomes more pertinent, especially if they intend to stay for the long term.

C. Your HDB Loan: The 2.6% Question in Today’s Climate

A cornerstone of the HDB home-ownership journey is the concessionary housing loan. As of May 2025, this interest rate remains unchanged at 2.6% per annum. This rate is intrinsically linked to the Central Provident Fund (CPF) Ordinary Account (OA) interest rate, pegged at 0.1% above the prevailing OA rate, which currently stands at 2.5% per annum.

When considering whether to pay down this 2.6% loan early, it’s essential to compare it with returns available from alternative low-risk savings or investment vehicles. As of May 2025, these alternatives generally offer yields lower than the HDB loan rate:

- The best 6-month fixed deposit rates are around 2.35% p.a..

- The best 12-month fixed deposit rates reach up to 2.45% p.a..

- The latest 6-month Treasury bill (T-bill) auction yielded approximately 2.30% p.a..

- The most recent Singapore Savings Bonds (SSB) issuance offers a 10-year average return of around 2.56% p.a. – a figure very close to the HDB loan interest rate.

The most direct financial argument for prepaying an HDB loan is often cited as saving on the 0.1% interest differential between the loan rate (2.6%) and the base CPF OA rate (2.5%). However, this simple comparison overlooks a crucial detail: the extra interest that CPF members can earn on their CPF balances. Members below the age of 55 earn an additional 1% interest per annum on the first $60,000 of their combined CPF balances, with this extra interest capped at $20,000 for the OA. For members aged 55 and above, the extra interest is even more generous.

Consider a member below 55 who has $20,000 in their OA, and this amount falls within the first $60,000 of their combined CPF balances. This $20,000 is effectively earning 3.5% per annum (2.5% base OA rate + 1% extra interest). Using these specific OA funds to pay off a 2.6% HDB loan would result in a net loss of 0.9% per annum in guaranteed, risk-free returns. This makes early repayment with such CPF OA funds financially disadvantageous for members benefiting from this extra interest, unless non-financial goals, such as the peace of mind from being debt-free, are considered paramount.

Given the prevailing low yields on comparable risk-free investments like fixed deposits and T-bills, there isn’t a compelling arbitrage opportunity to maintain the HDB loan and invest spare cash elsewhere risk-free for a significantly higher return. Therefore, the decision to not prepay the loan would largely hinge on factors such as the need for liquidity, the pursuit of higher-risk but potentially higher-return investments, or the strategy of maximizing the effective interest earned within the CPF OA (which, as shown, can be higher than the base 2.5%). If alternative safe investments consistently offered returns substantially above 2.6%, it would make clear financial sense to keep the HDB loan and invest surplus cash. Since this is not the case in May 2025, the choice shifts to comparing the 2.6% loan cost against the CPF OA’s effective rate, the value of liquidity in an uncertain economic climate 1, and the potential returns (along with associated risks) from equities or other investment classes.

Table 1: Key Financial Indicators (May 2025)

| Indicator | Rate/Value | |

| HDB Concessionary Loan Rate | 2.6% p.a. | |

| CPF Ordinary Account (OA) Base Interest Rate | 2.5% p.a. | |

| CPF OA Effective Rate on first $20K (if part of first $60K combined balances, for members under 55) | 3.5% p.a. | |

| MAS Core Inflation Forecast 2025 | 1.0% – 2.0% | |

| Singapore GDP Growth Forecast 2025 | 0.0% – 2.0% | |

| Best 12-month Fixed Deposit Rate (Indicative) | ~2.45% p.a. | |

| Latest 6-month T-Bill Yield (Indicative) | ~2.30% p.a. | |

| Singapore Savings Bonds (SSB) Latest 10-year Average Return (Indicative) | ~2.56% p.a. |

This table provides a snapshot of the core financial data points influencing the HDB loan repayment decision. It allows for an immediate comparison of the HDB loan rate against what money could be earning in CPF or other low-risk alternatives, all within the context of the broader economic climate. This direct comparison is fundamental to the subsequent discussion.

II. Early HDB Loan Repayment: The Mechanics and Key Considerations

Beyond the macroeconomic environment, understanding the specific mechanics of HDB loans and CPF usage is crucial when contemplating early repayment.

A. The Freedom of No Penalties for HDB Loans

A significant advantage of HDB concessionary housing loans is the absence of any lock-in period or financial penalty for making early partial or full repayments. This flexibility stands in stark contrast to most bank loans, which typically impose lock-in periods ranging from one to three years. During these lock-in periods, borrowers who wish to repay their loan early or refinance with another institution often face penalties, commonly around 1.5% of the outstanding loan amount.

This inherent flexibility in HDB loans allows homeowners to make strategic repayments whenever they have surplus funds—perhaps from a year-end bonus, an inheritance, or accumulated savings—without incurring additional costs. Such a feature is particularly valuable in an economic climate marked by uncertainty, where personal financial situations can change unexpectedly. It provides an avenue for opportunistic debt reduction if desired, without the deterrent of penalties that could otherwise negate the benefits of early repayment. The absence of these penalties removes a common barrier, making the decision to prepay an HDB loan primarily a matter of weighing opportunity costs and personal financial priorities.

B. The CPF Factor: Using Your OA Savings and Understanding Accrued Interest

CPF OA savings play a central role in HDB home financing, commonly used for both the initial downpayment and ongoing monthly loan installments. HDB rules permit borrowers to retain up to $20,000 in their OA when taking an HDB loan, offering a buffer for future needs.

However, a critical aspect to comprehend is the concept of accrued interest. When CPF OA funds are utilized for housing purposes, the principal amount withdrawn, along with any interest that these funds would have earned had they remained in the OA (currently calculated at 2.5% per annum and compounded annually), must be refunded to the member’s CPF account upon the eventual sale of the property. The longer CPF funds are used for housing and the larger the amount withdrawn, the higher the accumulated accrued interest that will need to be repaid. This can significantly reduce the cash proceeds a homeowner receives from the sale of their flat.

This leads to a common point of misunderstanding: prepaying an HDB loan using CPF OA funds is not financially equivalent to prepaying with cash. While using OA funds for prepayment does reduce the outstanding HDB loan balance (and thus the 2.6% interest charged on that portion), it simultaneously increases the amount “owed” back to one’s own CPF OA, an amount that continues to accrue interest at 2.5%. The net “saving” in terms of interest rate differential is merely 0.1% (2.6% loan rate – 2.5% OA accrued interest rate). This marginal saving comes at the cost of losing the liquidity and potential alternative uses of those OA funds, and the homeowner still faces the prospect of a substantial CPF refund upon selling the property. Homeowners might see their HDB loan balance decrease and feel they have “saved” 2.6% interest, but they must also account for the corresponding increase in “CPF principal withdrawn for housing” on their CPF statement, which continues to compound at 2.5%.

For individuals who plan to “right-size” their homes later in life or who are relying on the cash proceeds from their HDB flat to fund their retirement, minimizing the use of CPF for the loan—including making early repayments from CPF—becomes a paramount consideration. Choosing to pay the mortgage with cash, or making early repayments with cash rather than CPF funds, helps preserve CPF savings for retirement. These preserved CPF funds could potentially earn higher effective rates if they qualify for extra interest or if they are transferred to the Special Account (SA) or Retirement Account (RA) at a later stage. Moreover, using cash for mortgage payments maximizes the cash proceeds received when the property is eventually sold. This strategy aligns with the goal of maximizing liquid funds available for retirement, as the CPF accrued interest directly impacts the cash available post-sale.

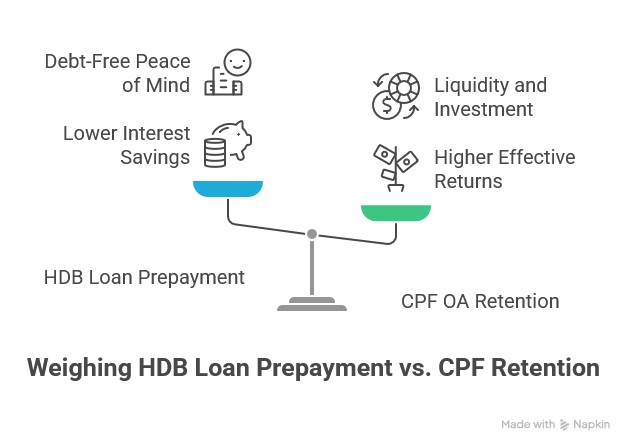

C. Weighing Your Options: Saving Loan Interest vs. Alternative Uses for Your Money

The core decision of whether to prepay an HDB loan boils down to a comparison: is the approximate 0.1% interest saving (or slightly more if the CPF OA funds used for prepayment are not earning any extra interest) a better outcome than alternative uses for that money? These alternatives include:

- Maintaining liquidity by keeping funds in easily accessible forms for emergencies or unforeseen opportunities, especially pertinent in an uncertain economic environment.

- Seeking potentially higher, albeit riskier, returns through investments in assets like stocks, bonds, or unit trusts.

- Allowing CPF OA funds to continue earning their base 2.5% interest, plus any applicable extra interest (potentially bringing the effective rate to 3.5% or higher for some balances).

- For older CPF members (aged 55 and above), channeling funds to top up their RA up to the Enhanced Retirement Sum (ERS), which offers a guaranteed return of 4% per annum.

In the context of May 2025, characterized by low GDP growth and relatively low (though recently falling) risk-free investment rates outside of CPF, the “opportunity cost” of prepaying the HDB loan is less about missing out on stellar external investment returns. Instead, it’s more about sacrificing liquidity and the guaranteed, often attractive, returns available within the CPF system itself (especially the extra interest on OA balances or the higher rates in the RA). If the economy were booming and safe investments consistently yielded significantly more than 2.6%, the opportunity cost of prepayment would be evidently high. However, in the current scenario, the comparison shifts inward, focusing on the merits of CPF’s internal rates and the intrinsic value of maintaining liquidity in an unpredictable economic landscape.

It is also important to acknowledge the psychological dimension of debt. The comfort and peace of mind derived from being debt-free can sometimes outweigh a purely mathematical financial analysis, especially when the direct financial differences are marginal (such as the 0.1% interest spread between the HDB loan and CPF OA accrued interest). In an world perceived as uncertain, the act of reducing fixed financial obligations can provide a significant sense of security. Behavioral economics research indicates that individuals often exhibit “debt aversion”, deriving utility from reducing debt even if a purely rational calculation might suggest investing the funds instead. The emotional relief that comes from eliminating a mortgage, particularly during uncertain times, can be a powerful, non-financial motivator for some.

III. Tailored Advice: Should YOU Settle Your HDB Loan Early?

The decision to prepay an HDB loan is not universal; it varies significantly based on an individual’s life stage, financial situation, and priorities.

A. The Young Professional (Mid-20s): Building Your Financial Future

Typical Profile & Priorities:

This demographic typically includes recent graduates or those in their first few jobs. Their income may be lower initially but has high growth potential. Key financial priorities often revolve around establishing a solid financial foundation. This includes building an emergency fund, ideally covering six to nine months of living expenses, paying off any high-interest consumer debt (like student loans or credit card balances), saving for future life goals such as marriage or further education, and crucially, starting early with investments to harness the power of long-term compounding. Given the current economic climate, salary and career progression are often top concerns. Many in this group would have recently taken on a significant HDB loan for a BTO flat, possibly with a maximum tenure of 25 years.

Pros of Early Repayment (for this group):

- A marginal interest saving (0.1% if using CPF OA funds not earning extra interest; potentially more if using cash that would otherwise earn less than 2.6%).

- The psychological satisfaction of reducing debt early in life.

- A shorter loan tenure means owning the flat outright sooner, which can feel like a significant achievement.

Cons of Early Repayment (for this group):

- Significant Opportunity Cost: Funds used for loan prepayment could instead be channeled into higher-growth assets like Exchange Traded Funds (ETFs) or individual stocks. Given their long investment horizon (20-30 years or more), even a modest average annual return of 5-7% from diversified investments would likely far outweigh the 2.6% interest saved on the HDB loan.

- Liquidity Strain: Early repayment reduces cash on hand, which is vital for their burgeoning emergency fund, potential investments in career development (e.g., professional courses), or other emerging life goals. This is particularly critical given potential job market vulnerabilities in a slowing economy.

- Forgoing Higher CPF OA Interest: If their CPF OA funds are part of the first $60,000 of combined CPF balances (with up to $20,000 in OA), these funds earn an extra 1% interest, resulting in an effective rate of 3.5%. Using these specific funds for early repayment of a 2.6% loan would represent a direct financial loss of 0.9% per annum on the amount prepaid.

Illustrative Example (Mid-20s):

Consider a young professional with a $300,000 HDB loan taken over 25 years at 2.6% per annum. The estimated monthly installment would be approximately $1,361. Suppose this individual considers making a $10,000 lump sum prepayment.

- If paid with cash (that was earning, say, 1.5% in a regular savings account): The net benefit is the difference between interest saved (2.6%) and interest forgone (1.5%), i.e., 1.1% on $10,000, plus the psychological benefit of debt reduction.

- If paid with CPF OA funds that are earning an effective 3.5% (due to extra interest): This would result in a net financial loss, as the 3.5% earned in CPF is higher than the 2.6% loan interest saved. The loss is 0.9% per annum on that $10,000.

- Alternative Use of $10,000: If this $10,000 were invested in a diversified global ETF aiming for an average annualised return of 7%, over 20 years, it could potentially grow to approximately $38,700 (before fees and taxes). This potential growth significantly surpasses the interest saved from prepaying the HDB loan.

Strategic Moves & Recommendations:

For young professionals in their mid-20s, the general recommendation is to prioritize foundational financial goals before considering early HDB loan repayment.

- Build an Emergency Fund: Aim for 6 to 9 months’ worth of living expenses in an easily accessible account.

- Clear High-Interest Debt: Focus on eliminating any credit card debt or personal loans that carry interest rates significantly higher than the HDB loan rate.

- Secure Basic Insurance Coverage: Ensure adequate health and life insurance protection. Early HDB loan repayment, especially using CPF OA funds, is generally not recommended for this group, particularly if those OA funds are benefiting from extra interest. The 2.5% (or 3.5% effective) risk-free return in the OA is valuable at this stage. If considering cash prepayment, it should only be an option after all higher-priority financial goals are met, if they possess substantial surplus cash earning less than 2.6% elsewhere, AND if they place a very high personal value on debt reduction over the potential for investment growth. The primary focus for this demographic should be on income growth through career development and initiating a disciplined, long-term investment plan. These activities are likely to yield far greater long-term financial benefits than the marginal interest savings from early HDB loan prepayment. The emphasis on “salaries as top priority” for fresh graduates in the current economic climate 1 suggests a focus on increasing earning power. This investment in human capital might be a better use of resources than deleveraging a low-cost HDB loan, as higher income provides greater financial flexibility and capacity for future savings and investments. Furthermore, the desire for financial independence among young adults might be better served by building a diversified asset base rather than concentrating surplus funds into an illiquid property asset, especially when the loan is relatively inexpensive and flexible.

B. The Growing Family (Mid-30s): Juggling Commitments

Typical Profile & Priorities:

Individuals in their mid-30s are often more established in their careers, potentially with higher incomes compared to their 20s. However, this stage of life typically comes with significantly increased expenses and financial commitments. These include childcare costs, saving for children’s education, potentially larger housing needs (which might involve considering an upgrade), and ensuring adequate insurance coverage for the entire family. They may hold a larger HDB loan or be in the process of planning for a property upgrade. While their time horizon for investments remains reasonably long, their risk tolerance might be slightly moderated due to the financial responsibilities towards dependents.

Pros of Early Repayment (for this group):

- Reduces the monthly mortgage burden, which can free up cash flow crucial for managing day-to-day family expenses.

- Provides a heightened sense of security, knowing that the family home is being paid off at an accelerated pace.

- Lowers the total amount of interest paid over the lifespan of the loan.

Cons of Early Repayment (for this group):

- Reduces Liquidity for Critical Needs: Family life is unpredictable. Funds used for prepayment are no longer readily available for emergencies, children’s immediate educational or medical needs, or other unforeseen circumstances. Cash flow is often king for this demographic.

- Opportunity Cost for Long-Term Goals: The money could be allocated to dedicated education savings plans for children or diversified investment portfolios, which might offer better long-term returns than the 2.6% interest saved on the HDB loan.

- Impacts Upgrading Potential: If moving to a larger property is a medium-term goal, tying up significant cash in prepaying the current HDB loan might reduce the available downpayment capacity for the next home.

Illustrative Example (Mid-30s):

Consider a family in their mid-30s with a $450,000 HDB loan (e.g., for a 5-room flat). The estimated monthly installment at 2.6% over 25 years would be approximately $2,042. Suppose they are considering a $20,000 lump sum prepayment.

- If paid with cash: This would free up some future cash flow by reducing the loan principal and potentially shortening the loan term or lowering subsequent installments (depending on how the prepayment is structured with HDB).

- If paid with CPF OA funds: The same considerations as for the younger group apply. If the OA funds are earning the base 2.5%, the net saving is 0.1%. If those OA funds are earning extra interest (e.g., 3.5% effective), making the prepayment would result in a financial loss. The accrued interest of 2.5% on the $20,000 used from CPF would also need to be refunded upon future sale.

- Alternative Use of $20,000: This sum could be invested in an education endowment plan for a child or a balanced investment portfolio. Given the long time horizon until a child’s tertiary education, such investments have the potential to grow substantially, possibly outpacing the interest saved on the HDB loan.

Strategic Moves & Recommendations:

For families in their mid-30s, financial planning must balance immediate needs with long-term aspirations.

- Prioritize an Adequate Emergency Fund: This should cover 6 to 9 months of their increased family living expenses.

- Ensure Comprehensive Insurance: This includes sufficient life and medical insurance for both parents and health coverage for children.

- Consistent Savings for Children’s Education: Start early and contribute regularly to dedicated education funds. Using CPF OA for monthly loan installments is generally acceptable if it helps preserve cash for other pressing family needs. However, it’s important to remain mindful of the growing accrued interest if there are plans to sell the flat later. Early repayment using cash should be considered only if all high-priority family financial safety nets (emergency fund, insurance) and critical savings goals (e.g., initial contributions to education funds) are well-funded. The benefit of increased monthly cash flow from a reduced mortgage must be carefully weighed against the reduction in liquid savings. A strong focus on budgeting and cash flow management is crucial. Tools like the 50/30/20 budgeting rule can be helpful. Families should also actively maximize government support schemes such as CDC Vouchers and childcare subsidies to alleviate financial pressures. The tension between current consumption and needs (children’s expenses, maintaining a certain lifestyle) and long-term savings (retirement, children’s tertiary education) is often most acute for this demographic. Early HDB loan repayment might intuitively feel like a prudent saving measure. However, it could inadvertently divert funds from more critical or potentially higher-returning “investments,” such as dedicated education funds or essential insurance coverage. Sacrificing liquidity or diverting funds from these goals for a marginal interest saving on a low-cost HDB loan might not represent the most optimal allocation of limited resources. The household income structure also plays a role. A single-income family might prioritize debt reduction more heavily to enhance financial security, whereas a dual-income family might have greater capacity to service debt comfortably while simultaneously pursuing other investment and savings goals. Income stability and overall household cash flow directly influence risk tolerance and financial capacity.

C. The Pre-Retiree (Late 40s to Mid-50s): Securing Your Golden Years

Typical Profile & Priorities:

Individuals in their late 40s to mid-50s are often at their peak earning years, but retirement is no longer a distant prospect—it’s looming within the next 10 to 20 years. Financial priorities shift decisively towards securing a comfortable and financially independent retirement. Key goals include maximizing retirement funds, particularly within the CPF system (such as topping up the Retirement Account to the Full or Enhanced Retirement Sum), ensuring adequate healthcare coverage for their senior years, and aiming for a debt-free retirement. Their outstanding HDB loan balance might be smaller than younger groups, but the time horizon to recover from any financial missteps is also shorter. Some may also be considering downsizing their property or other forms of property monetization.

Pros of Early Repayment (for this group):

- Achieves Debt-Free Retirement: This is a major psychological and financial milestone for many, freeing up significant cash flow during retirement when active income typically ceases.

- Reduces Financial Risk: Eliminating mortgage obligations before retirement income drops provides a greater sense of security and stability.

- Simplifies Finances: Fewer bills and financial commitments to manage in older age can reduce stress and complexity.

Cons of Early Repayment (for this group):

- Opportunity Cost vs. CPF RA/ERS Top-Up: This is a critical consideration. Funds that could be used for HDB loan prepayment might be more advantageously channeled into their CPF Retirement Account (RA), especially up to the Enhanced Retirement Sum (ERS). The RA currently offers a risk-free return of 4% per annum.17 This is significantly better than the 2.6% interest saved on the HDB loan.

- Liquidity for Healthcare: Healthcare costs tend to increase with age. Maintaining sufficient liquid savings for unforeseen medical expenses or long-term care needs is crucial.

- Impact of Special Account (SA) Closure (at age 55): Upon reaching 55, a member’s SA is closed, and funds from the SA (and OA if needed) are transferred to form the RA, up to the Full Retirement Sum (FRS). Any excess SA funds beyond what’s needed for the RA (if FRS is met) and future CPF contributions (if RA is at FRS) are typically channeled to the OA, where they earn the base 2.5% interest (plus any applicable extra interest). If the RA is already at the ERS, then using surplus OA funds to pay off the 2.6% HDB loan becomes more attractive than leaving them in the OA earning only 2.5% (assuming no extra interest applies or the cap for extra interest is met).

Illustrative Example (Late 40s-Mid 50s):

Consider an individual in this age group with a remaining HDB loan balance of $100,000. They have a lump sum of $20,000 available.

- Option 1: Prepay $20,000 of the HDB loan using cash or OA funds (assuming OA funds earn only 2.5%). This saves 2.6% interest on the $20,000 principal. If OA funds are used, the net saving is 0.1% after accounting for the 2.5% accrued interest.

- Option 2 (If aged 55 or older and RA is not yet at ERS): Top up their RA with the $20,000. This $20,000 will earn a guaranteed 4% per annum. This is clearly a superior financial outcome compared to prepaying a 2.6% loan.

- Option 3 (If aged 55 or older, RA is already at ERS, and the $20,000 is in their OA earning only 2.5%): In this specific scenario, prepaying the 2.6% HDB loan with these OA funds offers a 0.1% net financial benefit, plus the significant non-financial benefit of achieving debt freedom closer to or in retirement.

Strategic Moves & Recommendations:

For pre-retirees, the hierarchy of financial actions should be carefully considered:

- Priority 1 (especially if aged 55 or older): Maximize CPF RA contributions up to the prevailing Enhanced Retirement Sum (ERS), which was $426,000 in 2025. The 4% risk-free return offered by the RA makes this the most compelling use of surplus cash or OA funds for this age group, as long as the ERS cap has not been reached.

- Priority 2: Ensure Sufficient Liquid Savings. This is for healthcare contingencies and general emergency needs during retirement. Early HDB loan repayment using cash or OA funds should be strongly considered if:

- Their CPF RA is already at the ERS (or they are not yet 55 but have a clear plan and capacity to maximize it upon reaching 55).

- They possess ample liquid savings even after making the loan prepayment.

- The psychological benefit of entering retirement debt-free is a high personal priority. If planning to sell the HDB flat to fund retirement (e.g., right-sizing), minimizing CPF accrued interest becomes important. In such cases, using cash for any remaining mortgage payments or for early loan repayment is preferable to using more CPF funds, as this will maximize the cash proceeds from the sale. The option to top up the RA to the ERS at a guaranteed 4% fundamentally shifts the decision-making process for those aged 55 and above. This government-backed, risk-free return is demonstrably superior to the 2.6% HDB loan cost, making RA top-up the mathematically optimal choice for surplus funds before considering HDB loan prepayment, unless the RA is already at its ERS limit. The 4% return in the RA offers a 1.4% positive arbitrage over the 2.6% HDB loan cost, representing a straightforward financial win. The closure of the SA at age 55 means that funds previously earning 4% in the SA (if not shielded) will now either be in the RA (continuing to earn 4%) or in the OA (earning 2.5% plus any applicable extra interest). Maximizing the RA component first is therefore key. Furthermore, for pre-retirees whose HDB flat forms a key part of their retirement asset base, becoming debt-free can simplify future property monetization strategies, such as renting out rooms or considering the Lease Buyback Scheme. A fully paid-off property offers greater flexibility for generating retirement income without the complication of servicing an outstanding mortgage from a potentially reduced retirement income. This aligns with the goal of securing stable passive income streams in retirement.

Table 2: Simplified Scenario – $10,000 Lump Sum: Prepay HDB Loan vs. Alternatives (Annualized Return/Saving)

| Action | Mid-20s Outcome on $10k (Annualized) | Mid-30s Outcome on $10k (Annualized) | Late 40s-50s Outcome on $10k (Annualized) | Notes |

| Prepay HDB Loan (Cash) | Saves 2.6% | Saves 2.6% | Saves 2.6% | Assumes cash would earn less than 2.6% elsewhere. |

| Prepay HDB Loan (CPF OA – base rate) | Net saves 0.1% | Net saves 0.1% | Net saves 0.1% | If OA earns only 2.5%; higher accrued interest to refund on sale. |

| Prepay HDB Loan (CPF OA – effective 3.5% rate) | Net loses 0.9% | Net loses 0.9% | N/A (Extra 1% on first $60k typically for under 55) | If OA part of first $60k combined balance. |

| Keep in CPF OA (earning 2.5% base) | Earns 2.5% | Earns 2.5% | Earns 2.5% | Baseline for comparison if no prepayment. |

| Keep in CPF OA (earning 3.5% effective) | Earns 3.5% | Earns 3.5% | N/A | If eligible for extra interest. |

| Invest in Fixed Deposit (e.g., 12-month) | Earns ~2.45% | Earns ~2.45% | Earns ~2.45% | Low risk, lower return than HDB loan cost. |

| Invest in SSB (e.g., 10-yr avg.) | Earns ~2.56% | Earns ~2.56% | Earns ~2.56% | Low risk, comparable to HDB loan cost. |

| Top up CPF RA (if 55+ & ERS not met) | N/A | N/A | Earns 4.0% | Highest risk-free return for this group. |

| Invest in Balanced/Growth Fund (hypothetical) | Potential 5-7% (with risk) | Potential 5-7% (with risk) | Potential 5-7% (with higher risk aversion near retirement) | Higher potential return, but carries market risk. |

This table visually and numerically demonstrates the direct trade-offs. It makes the opportunity cost tangible and helps compare the “sure thing” of loan interest saving against other potential uses of funds, tailored to life stage.

IV. Beyond the Math: The Psychology of Debt and Your Peace of Mind

Financial decisions are rarely made on numbers alone. Emotions, personal comfort levels, and psychological factors play a significant role, especially when it comes to a substantial commitment like a home mortgage.

A. The Emotional Weight of Debt vs. The Drive to Invest

Many individuals experience what behavioral economists term “debt aversion”—a psychological preference to be free of debt, even if retaining some low-cost debt might be the more mathematically optimal financial decision. The emotional burden of carrying debt, particularly a large mortgage, can be significant for some, leading to stress or anxiety. In an economic climate marked by uncertainty, such as that of May 2025 with concerns about job security and economic slowdown, the psychological comfort derived from reducing or eliminating a major debt like a mortgage might carry an even higher premium. This desire for security can sometimes outweigh small potential financial gains from keeping the loan and investing conservatively elsewhere. Financial decisions are not made in a vacuum; emotions and individual psychology are influential. During times of economic stress, the innate human desire for control and security often increases. Reducing debt is a tangible way to achieve a greater sense of control, providing a peace of mind that might be valued more highly than a marginal investment return.

Conversely, other individuals are more motivated by the potential for wealth creation through investing. They are comfortable accepting calculated risks in pursuit of higher returns. For them, a low-interest HDB loan might be seen as “good debt,” allowing them to free up capital for investments that could potentially yield far more than the interest paid on the loan.

The “quick win” satisfaction often associated with paying off smaller debts first (a behavioral strategy to build momentum) might not apply as directly to a large, long-term HDB loan. However, the overarching goal of eventually becoming mortgage-free can serve as a powerful long-term motivator. Some homeowners derive immense satisfaction from seeing their loan balance decrease and working towards full ownership, an ambition that can influence their decision to allocate surplus funds towards prepayment, even if done incrementally over many years.

B. Finding Your Personal Balance

Ultimately, effective financial planning must align with an individual’s unique circumstances, risk tolerance, and personal goals. There is no single “right” answer to the question of early HDB loan repayment that applies to everyone. While financial analysis provides a quantitative framework for comparison—pitting the 2.6% HDB loan rate against the 2.5% base CPF OA rate, potential extra CPF interest, the 4% RA rate, or returns from other investments—qualitative factors are equally important. An individual’s inherent aversion to debt, their specific family needs and responsibilities, their aspirations for their retirement lifestyle, and other non-financial priorities will collectively shape what they perceive as the “best” decision for themselves.

V. Making the Right Choice for You in May 2025

Navigating the decision of whether to prepay an HDB loan requires a careful synthesis of financial data, personal circumstances, and the prevailing economic conditions.

A. Key Takeaways and Final Checklist

To recap the core financial landscape of May 2025: the HDB concessionary loan rate stands at 2.6%, while the CPF OA base interest rate is 2.5%. However, CPF members can earn extra interest on certain OA balances, and those aged 55 and above can benefit from a 4% per annum return by topping up their Retirement Account (RA) to the Enhanced Retirement Sum (ERS). Prevailing yields on other low-risk investments like fixed deposits and Singapore Savings Bonds are generally at or below the HDB loan rate. The economic context is one of slowing growth and a cautious job market, though the HDB loan environment itself remains stable.

Before making a decision, consider the following checklist:

- Emergency Fund: Is an adequate emergency fund (typically 6-9 months of living expenses) securely in place?

- High-Interest Debt: Are there any other debts (e.g., credit cards, personal loans) with interest rates significantly higher than 2.6% that should be cleared first?

- Effective CPF OA Rate: What is the actual effective interest rate the CPF OA funds are currently earning, including any extra interest? (If it’s 3.5% or higher, using these funds to pay a 2.6% loan is generally not advisable).

- CPF RA Status (if aged 55+): Has the CPF RA been topped up to the current ERS? (If not, this is likely the best use of surplus funds, offering a 4% risk-free return).

- Alternative Investments: What are the available alternative investment options, and what are their associated risks and potential returns compared to the 2.6% loan interest saving?

- Liquidity Needs: How important is maintaining financial liquidity in the current economic climate and for upcoming life events?

- Long-Term Financial Goals: How does early loan repayment align with broader long-term goals, such as plans for property sale, funding children’s education, or desired retirement lifestyle?

- Psychological Value of Debt Freedom: How much personal value or peace of mind would be derived from being debt-free or reducing mortgage obligations?

B. Empowering Your Decision

The information presented in this guide is intended to empower HDB homeowners to make a choice that aligns with their unique financial situation and life goals. In the specific context of May 2025, for many individuals, aggressively prepaying the HDB loan, particularly with CPF OA funds, is unlikely to be the most financially optimal move. This is primarily due to the narrow interest rate spread between the HDB loan (2.6%) and the base CPF OA rate (2.5%), the significant value of potential extra interest earned on OA balances (up to 3.5% or more for some), and the superior 4% risk-free return available in the CPF RA for those 55 and above who have not yet reached the ERS.

The current economic outlook, with its emphasis on cautious growth and potential job market uncertainties, also underscores the importance of maintaining liquidity. Low returns on external safe investments further mean there’s little pressure from that angle to quickly pay down a relatively cheap HDB loan.

Prepayment with cash is a more nuanced decision. It depends heavily on an individual’s overall financial health, their access to alternative investment opportunities that can reliably outperform 2.6% after risk and taxes, and the personal value they place on debt reduction. For pre-retirees who have already maximized their RA to the ERS and have surplus cash or OA funds earning only the base 2.5%, using these funds to clear the HDB loan can be a sensible step towards a debt-free retirement.

The overarching theme for May 2025 is one of caution and prioritization. Maximizing guaranteed higher returns within the CPF system (like RA top-ups or benefiting from OA extra interest) and preserving liquidity should generally take precedence over making early HDB loan repayments where the financial benefits are marginal or even negative.

Ultimately, the “no penalty” feature of HDB loans provides valuable flexibility. If circumstances change, or if a household’s financial position improves significantly, the option to make partial or full prepayments remains open. If still unsure, consulting with a qualified and unbiased financial advisor can provide personalized guidance tailored to one’s specific needs and aspirations.