Singapore Retirement Calculator

A goal-based planner to chart your path to financial independence.

What This Calculator Does for You

This tool provides a holistic view of your retirement plan by helping you:

Define Your Goal: You start by defining what matters most: the lifestyle you want in retirement and the CPF LIFE plan you are aiming for.

Project Your Personal Investments: It simulates the growth of your current investments and annual contributions from today until the day you retire.

Calculate Your Required Nest Egg: It determines the total amount of personal investments you’ll need to fund your lifestyle after your CPF LIFE payout, accounting for decades of future inflation.

Provide a Clear Verdict: By comparing your projected savings to your required amount, it tells you if you have a surplus or a shortfall.

Visualize Your Journey: It generates a clear chart showing the rise and fall of your investment balance over your entire lifetime.

Offer Actionable Recommendations: If there’s a shortfall, it doesn’t leave you stranded. It provides three concrete suggestions—Save More, Retire Later, or Spend Less—with the exact numbers needed to get you back on track.

How to Use the Calculator: A Quick Guide

The form is designed to be simple and goal-oriented. Here’s what each field means:

1. Your Profile & Goals

Current Age: Your age today. This sets the starting line for your plan.

Retirement Age: The age you plan to stop working and start enjoying your savings.

Target Monthly Retirement Spending: This is your most important goal. Enter the lifestyle cost you want, in today’s dollars. The calculator will automatically adjust this number for inflation.

2. Your Savings & Investments

Target CPF LIFE Plan: Select the CPF income level you’re aiming for. This sets the foundation of your retirement income.

CPF Health Check (Optional): Click the [Check if you are on track] button to run a simple projection to see if your current CPF savings path aligns with the goal you’ve selected.

Current Personal Investments: The total value of all your non-CPF investment assets today (e.g., stocks, unit trusts, SRS, bonds, etc.).

Annual Contribution to Investments: The total amount of new money you add to your personal investments each year.

3. Key Assumptions

Average Investment Return: The estimated average growth rate for your personal investments over the long term. Historically, a diversified portfolio of stocks and bonds has returned 5-7% per year, but you should adjust this based on your own risk tolerance.

Long-term Inflation Rate: The rate at which you expect the cost of living to rise each year. For Singapore, a long-term average of 2.5% is a common and reasonable assumption.

5 Essential Tips On How to Begin Preparing for Retirement

1. Use Your Greatest Advantage: Start Today, No Matter What

The most powerful tool in your retirement plan isn’t a stock or a bond; it’s time. The earlier you start saving, even with small amounts, the more work “compound interest” can do for you. Think of it like a tiny snowball at the top of a very long hill. As it rolls, it picks up more snow, getting bigger and faster on its own.

A dollar you invest at age 25 is worth far more than a dollar you invest at age 45. Don’t wait until you have a “large amount” to begin. The key is to start now and let time do the heavy lifting.

2. Figure Out Your “Magic Number”: How Much You’ll Actually Need

Retirement isn’t a vague dream; it’s a specific financial goal. You need to know what you’re aiming for. Take some time to answer this question: “What kind of lifestyle do I want when I retire?”

Estimate Your Monthly Budget: Think about your future expenses like housing, food, utilities, hobbies, and travel. A common starting point is to aim for about 80% of your last pre-retirement salary.

Use a Retirement Calculator: Once you have a rough monthly figure (in today’s dollars), use a reliable retirement calculator. It will help you factor in inflation to determine the total nest egg, or “magic number,” you need to accumulate to fund that lifestyle for the rest of your life.

3. Know Your Foundation: Understand Your National Pension Plan (like CPF)

Before you worry about your personal investments, understand what’s already being saved for you automatically. In Singapore, this is your Central Provident Fund (CPF).

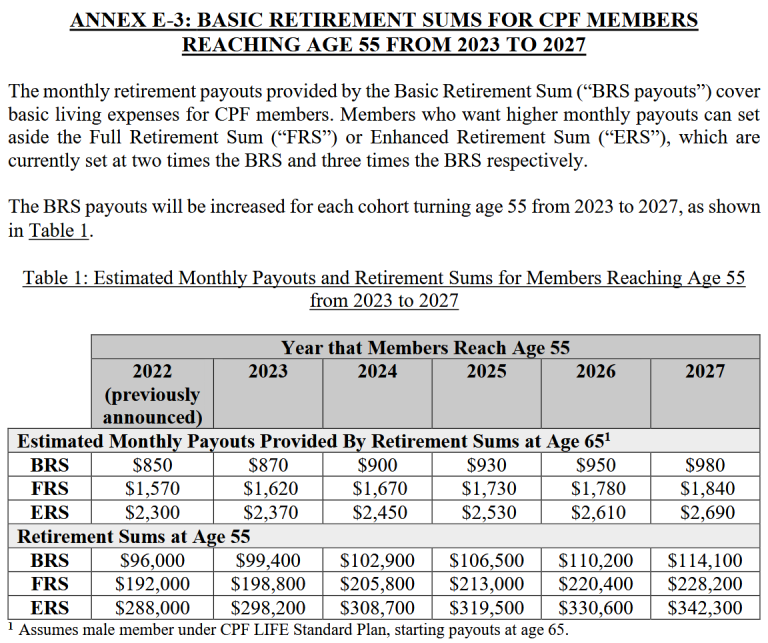

Learn Your Estimated Payouts: Understand the difference between the Basic, Full, and Enhanced Retirement Sums (BRS, FRS, ERS). This will give you a clear idea of your foundational, guaranteed monthly income in retirement.

See It as Your “Safety Net”: Your national pension is your most reliable income stream. By knowing this amount, you can calculate the “gap” that your personal savings and investments need to fill. Your retirement plan is essentially a mission to close that gap.

4. “Pay Yourself First”: Automate Your Savings and Investments

Don’t rely on willpower alone to save money. The most effective strategy is to make it automatic. Set up a system where your savings are “paid” just like any other bill as soon as you receive your salary.

Set Up Automatic Transfers: Arrange for a recurring transfer from your salary account to your investment accounts every single month. This could be a transfer to a robo-advisor, a brokerage account, or your SRS account.

Treat Savings as a Non-Negotiable Expense: By making your investment contributions automatic, you remove the temptation to spend the money first. You will naturally adjust your lifestyle to live on the remaining amount, ensuring you always hit your savings goals without thinking about it.

5. Build Your “Personal Savings Engine”: Diversify and Review

The money you save needs to grow faster than inflation. This is the role of your personal investment portfolio.

Don’t Put All Your Eggs in One Basket: The simplest way to start is with a diversified mix. This typically means owning a combination of growth assets (like stocks or equity funds, which have higher potential returns but more risk) and stable assets (like bonds, which have lower returns but provide stability).

Keep It Simple: You can achieve this easily with robo-advisors or by investing in a small number of broad-market Exchange Traded Funds (ETFs).

Schedule an Annual “Health Check”: Once a year, sit down and review your plan. Are you still contributing regularly? Are your investments still aligned with your goals? A quick annual check-up keeps your long-term plan on the road to success.

Important Assumptions & Limitations

To keep this calculator powerful yet simple, it makes several key assumptions. It’s important to understand these to use the results wisely.

CPF Payouts are Estimates: The monthly payout values in the dropdown (BRS, FRS, ERS) are based on the 2026 cohort turning 55, assuming the CPF LIFE Standard Plan is chosen. Your actual payout may differ based on your gender, the exact age you start your payout, and prevailing annuity rates when you retire.

Investment Returns are Consistent: The calculator uses a smooth, average rate of return every single year. In reality, your investments will have good years and bad years. This model shows a long-term average, not short-term market volatility.

Inflation is Constant: Similar to investment returns, the inflation rate is modeled as a smooth average.

Taxes are Not Factored In: The simulation does not account for income tax on your salary or taxes on investment returns from overseas markets.

This is an Educational Tool, Not Financial Advice: This calculator is a powerful tool for planning and understanding your financial direction. However, it is not a substitute for professional financial advice. Always consult a licensed financial advisor for decisions about your personal situation.

By understanding these assumptions, you can use this tool to build a robust and confident plan for your retirement future.