The Comfortable Lie We Tell Ourselves

Picture this: You’re 65, mortgage-free, and every month like clockwork, rental income flows into your bank account. No boss, no alarm clocks—just passive income from bricks and mortar. For decades, this has been the Singaporean retirement fantasy, passed down like gospel at coffee shops and family gatherings.

Even our government reinforces this narrative. As Senior Minister of State Koh Poh Koon put it: “CPF Life gives a regular monthly payout for life, much like receiving rental income from a property.“

But here’s the uncomfortable truth: This comparison, while comforting, obscures more than it reveals. When you run the actual numbers and examine the real-world mechanics of both options, five surprising realities emerge—realities that could fundamentally reshape your retirement strategy.

Truth #1: The “Rental Income” Comparison Is Dangerously Misleading

Yes, both CPF LIFE and rental income put money in your account each month. But that’s where the similarities end. Comparing them is like comparing a government bond with running a hawker stall because both “generate income.”

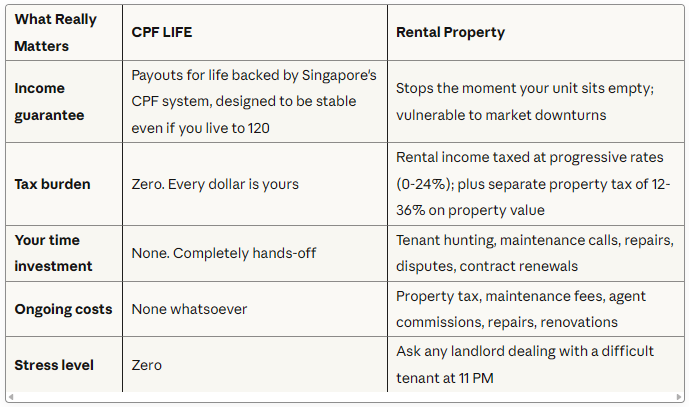

Let’s strip away the comforting analogy and look at what you’re actually getting:

One is a pension. The other is a small business disguised as passive income. The language we use—”rental income,” “passive”—actively obscures this fundamental difference.

Truth #2: Property Delivers Lower Returns on Significantly More Capital

This is where the numbers get really interesting. Most people assume property wins on pure returns. The math tells a different story.

To generate S$1,730 monthly from CPF LIFE (the 2025 Standard Plan payout):

- Capital required: S$213,000 (Full Retirement Sum)

- Annual payout rate: 9.7% tax-free

- Why 9.7%? Simple math: You receive S$1,730 every month (S$20,760 per year) from your S$213,000. That’s S$20,760 ÷ S$213,000 = 9.75% annually. This continues for life—whether you live to 75, 95, or 105. If you live to 85 (20 years of payouts), you’ll receive S$415,200 total from your S$213,000 capital. Live to 95? That’s S$623,280. The longer you live, the better this “rate” becomes.

To generate similar income from property (using a 4-room HDB flat at Pine Ville @ AMK):

- Capital required: S$585,000 (median value for 93 sqm unit based on recent pricing)

- Estimated gross rental income: S$3,400-3,800/month (typical for 4-room flats in Ang Mo Kio)

- Annual gross yield: 7.0-7.8% before tax and expenses

Wait—did you catch that? You need nearly 3x the capital to generate property income, yet your gross return at best matches (and often falls below) CPF LIFE’s payout rate. And we haven’t even deducted income tax (progressive rates up to 24%), property tax (12-36% of Annual Value for non-owner-occupied properties), agent fees (typically 1 month’s rent annually), maintenance costs, or periods of vacancy.

After expenses and taxes, many property owners are looking at net yields of 4-5%—less than half of CPF LIFE’s payout rate. For a Pine Ville @ AMK 4-room unit valued at S$585,000, generating S$3,600/month in rent translates to just S$43,200 gross annually. After income tax on rental income (~S$3,000-8,000 depending on your total income), property tax (~S$3,500-5,000 for non-owner-occupied), agent fees (~S$3,600), and maintenance (~S$2,000), your net could drop to around S$26,000-32,000—a 4.5-5.5% net yield before accounting for vacancy periods or major repairs.

The supposed “high-return investment” requires triple the capital for potentially half the actual return. This isn’t just surprising—it’s the opposite of conventional wisdom.

Truth #3: "Passive Income" Is Code for "Unpaid Part-Time Job"

Let’s talk about what “passive” rental income really means in practice.

When your air conditioning unit dies in July, you’re paying for it. When your tenant’s child draws on the walls, you’re dealing with it. When the market softens and you have three months of vacancy, you’re still paying property tax, maintenance, and the opportunity cost of dead capital.

And the market is softening. Savills Research reported that nearly 20,000 new private residential units were completed in 2023—more than double the 2022 figure and the highest since 2016. Online landlord forums are filled with complaints about prolonged vacancies and declining bargaining power.

Meanwhile, CPF LIFE depositors are doing exactly what Senior Minister Koh described: receiving payouts without worrying about “tax, that no one wants to rent the property or spend money to maintain it.”

One system requires you to become a property manager, negotiator, handyman coordinator, and market analyst. The other requires you to… exist.

Truth #4: The 35% Guaranteed Boost Nobody Talks About

Here’s a feature of CPF LIFE that deserves far more attention: the deferment bonus.

Every year you delay your CPF LIFE payouts beyond age 65 (up to age 70), your monthly income increases by approximately 7%. Defer for the full five years, and you lock in a 35% higher payout for the rest of your life.

Let’s put numbers to this. With the Full Retirement Sum of S$213,000:

- Start at 65: S$1,730/month for life

- Start at 70: S$2,335/month for life

That’s an extra S$605 every month, guaranteed, for simply delaying the start date. As the government noted, “this additional payout may be more than the salary increment if one continues working until 70 years old.”

This is a risk-free, guaranteed 35% increase in your payouts. No market timing required. No renovation costs. No tenant interviews. Just math and patience.

Now compare this to property: Where’s your guaranteed 35% rental increase mechanism? In today’s oversupplied market, you’re more likely to see rental compression than rental growth.

Truth #5: CPF LIFE's "Flaw" Is Actually Its Core Feature

The most common complaint about CPF LIFE is its rigidity. You can’t withdraw a lump sum. You can’t exit the scheme except by leaving Singapore permanently. For many, this feels like their money is being held hostage.

But this isn’t a bug—it’s the entire point.

CPF LIFE isn’t designed to be a savings account or an investment portfolio. It’s longevity insurance—protection against the very real risk of outliving your money. The “inflexibility” is the mechanism that ensures you cannot accidentally or intentionally undermine your own retirement security.

This reflects a fundamental principle of Singapore’s social policy: protecting citizens from predictable human biases. We consistently underestimate how long we’ll live. We overestimate our ability to manage money across 30+ years of retirement. We make decisions in our 60s that our 85-year-old selves will regret.

The system’s rigidity isn’t a flaw to be tolerated—it’s the feature that delivers the core promise: a dependable income stream you cannot outlive, no matter what.

Property offers no such guarantee. Sell too early out of fear, hold too long out of greed, face unexpected medical bills, get pressured by family—there are countless ways to lose your retirement nest egg. CPF LIFE removes these failure modes entirely.

The Real Question Isn't "Which?" But "How?"

The entire framing of “CPF LIFE versus property” is wrong. They’re not competitors—they’re complementary tools serving entirely different purposes.

CPF LIFE is your foundation: Lifelong income backed by Singapore’s CPF system that covers your essential needs regardless of market conditions, health status, or how long you live.

Property is your growth engine: a leverageable asset that can provide additional income and potential capital appreciation, but only if you have the capital, risk tolerance, time, and energy to manage it properly.

The sophisticated retirement strategy isn’t choosing one over the other. It’s using CPF LIFE’s guaranteed income floor to give you the confidence and security to take calculated risks with additional capital—whether in property, equities, or business ventures.

What This Means for Your Retirement Planning

If you’re still working toward retirement:

- Max out your CPF contributions before stretching to buy investment property. That 9.7% payout rate is nearly impossible to beat on a risk-adjusted basis.

- Consider the deferment option seriously. If you can work or have other income sources until 70, that 35% permanent boost could be worth far more than five years of property rental income.

- Calculate the real property math. Include vacancy periods, maintenance, taxes, and the opportunity cost of capital. You might be shocked at what your actual net yield is.

- View property as enhancement, not foundation. If you can afford investment property after securing your CPF LIFE base, great. But never sacrifice the foundation for the enhancement.

The Singaporean retirement dream doesn’t have to be fantasy. But it does require looking past comfortable myths and dealing with uncomfortable mathematics.

Your 85-year-old self will thank you for it.

About 563amk.com

563amk.com is run by The Pine Ville Cat, a professional void deck observer with over 7 years of napping experience in the Ang Mo Kio SERS blocks. All analysis is based on publicly available information, extensive void deck surveillance, and the occasional overheard conversation between property agents. For serious housing decisions, please consult actual humans with property licenses. For napping spot recommendations, The Pine Ville Cat is available for consultation (payment in tuna accepted).

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, tax, or legal advice. The information presented is based on publicly available data as of November 2025 and includes assumptions, estimates, and calculations that may not reflect your personal circumstances.

CPF LIFE figures are based on 2025 rates and eligibility criteria, which are subject to change by the CPF Board. Property values, rental rates, and market conditions fluctuate and past performance does not guarantee future results. Tax rates and regulations may change and vary based on individual circumstances.

Rental income calculations are estimates based on market research for the Ang Mo Kio area and may not reflect actual rental rates achievable for specific properties. Property expenses including maintenance, taxes, and vacancies can vary significantly.

Readers should conduct their own due diligence and consult qualified financial advisors, tax professionals, and legal experts before making any retirement planning, investment, or property decisions. The author and publisher assume no liability for decisions made based on information in this article.

Every individual’s financial situation, risk tolerance, and retirement goals are unique. What works for one person may not be suitable for another.