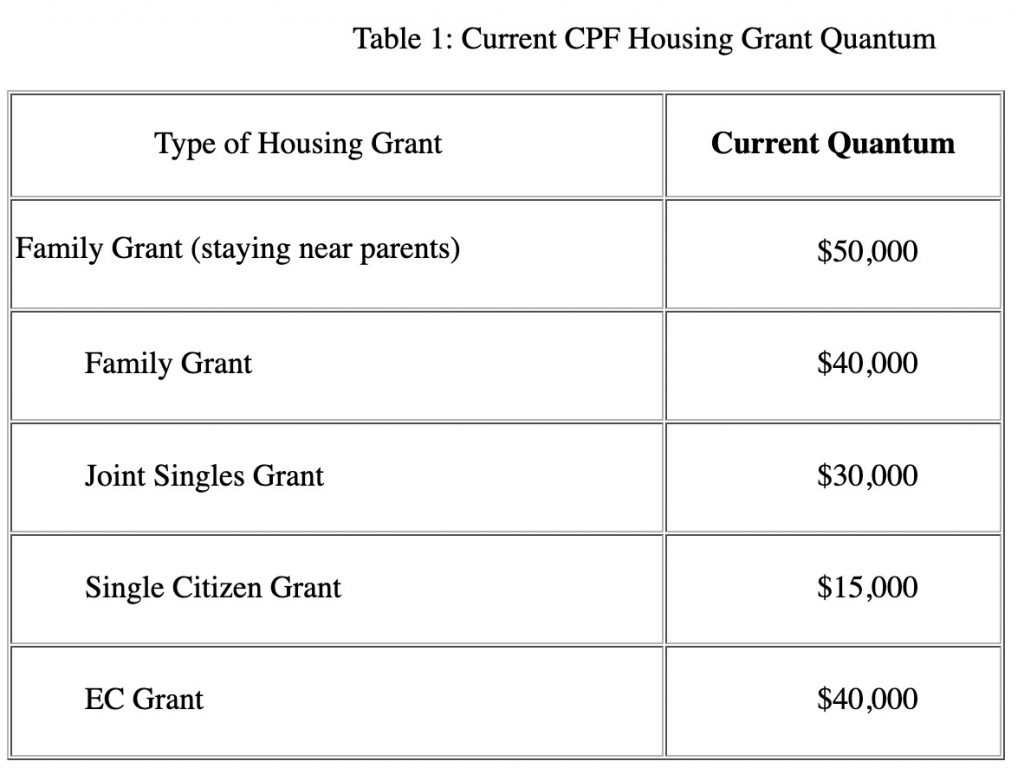

We decided to try applying for the Near The Parent Grant since $50,000 was really a big sum of money to help us own our 1st HDB home.

So we started looking for a HDB resale flat around Ang Mo Kio. After a few viewings, we decided on this current unit among Block 562 – 565. As a long range planner, we like the idea of a huge piece of land at the intersection of CTE and AMK Ave 3 and that plot was only occupied by 4 HDB blocks. We also like the huge carpark even though we cannot afford a vehicle 😅

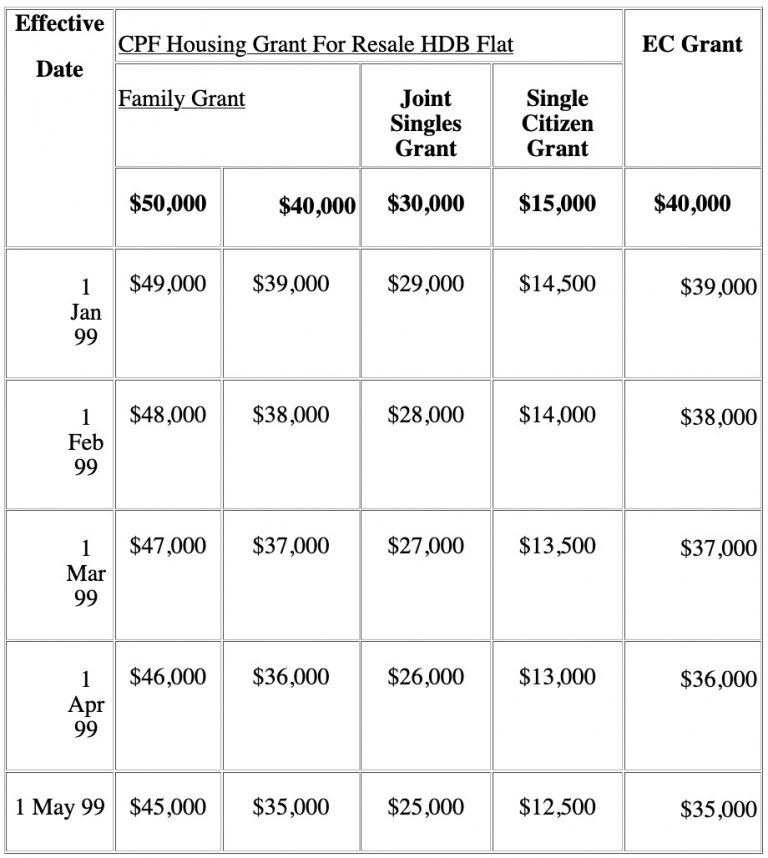

However, the government decide to slash $1,000 every month and eventually reducing the grant to S$45,000 in 1st May 1999.

We bought the resale flat and got S$49,000 HDB Near The Parent grant. After offsetting the S\$49,000 grant, I only need to take a \$19x,xxx-ish HDB loan at 2.6% interest and then slowly pay off a 25 years loan with my CPF. Little that in the later stage in life than I realised that CPF charges another 2.5% interest of the money that I lend to myself for paying for my home 😒🙄