The Million-Dollar Question: How SERS Treated Ang Mo Kio’s “Jumbo” Flat Owners

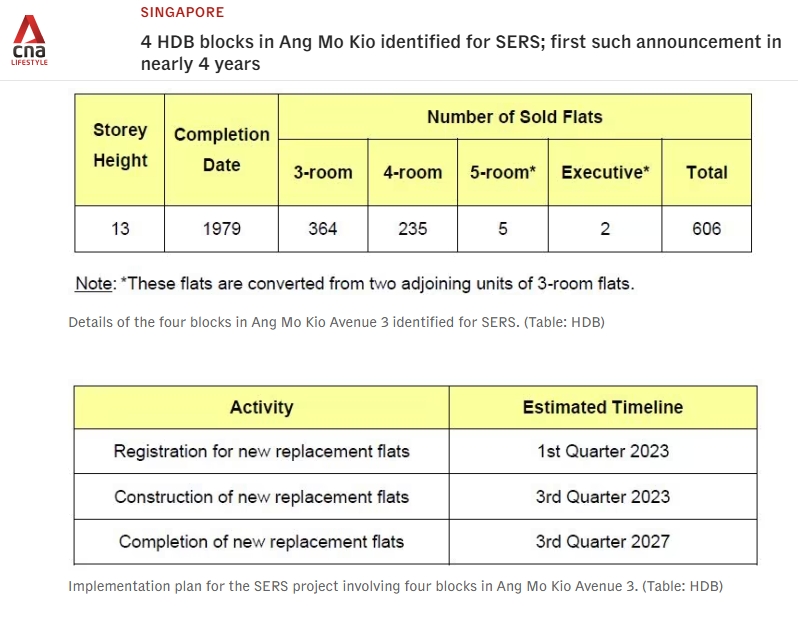

When the government announced the Selective En bloc Redevelopment Scheme (SERS) for four blocks at Ang Mo Kio Avenue 3 in April 2022, most residents focused on the obvious questions: How much compensation? Can I afford a replacement flat? Will my community stay together?

But for seven households living in converted “jumbo” flats, a different question loomed large: Would the government value their unique properties as single premium units or split them back into two separate 3-room flats?

The answer would determine whether they’d walk away with roughly $450,000 or nearly $1 million.

The Adjoined Flat Dilemma

In the Ang Mo Kio SERS exercise, 7 families owned rare "Jumbo" units created by merging two flats. Research reveals a complex valuation challenge: One Title vs. Two Titles, and a significant size mismatch at the new site.

Explore the DataThe Inventory: Finding the Unicorns

Out of over 600 units in the precinct, only a handful are converted flat types. These owners faced a unique problem: their current homes are significantly larger than the even the largest new 3Gen flats.

Unit Breakdown

- Standard 3-Room ~350 units

- Standard 4-Room ~250 units

- Merged (5-Rm Equiv) 5 units

- Merged (EA Equiv) 2 units

Proportion of Affected Units

Valuation: The "Single Title" Impact

Research into HDB valuation principles for SERS indicates that adjoined flats are valued as a single strata title. While they command a premium over a single 3-room flat, they often fetch less than two separate 3-room flats combined, and crucially, they attract only one set of SERS benefits.

Compensation Rules

-

1

Market Value: Based on comparable "Jumbo" transactions, not sum of parts.

-

2

SERS Grant: Capped at $30,000 per eligible household (Single Title = 1 Grant).

Estimated Valuation Gap (2022)

The Size Mismatch

Central Weave @ AMK offers 5-Room and 3Gen flats, but they top out at ~115 sqm. For an Adjoined unit owner (~140-150 sqm), this still represents a significant downsizing.

Compensation Estimator

Compare Estimated Windfall vs Replacement Cost

*Warning: You lose ~40sqm of space.

The Forgotten Asset Class

Before we dive into the numbers, let’s understand what made these seven units special. Back in the 1990s, HDB introduced the Conversion Scheme to address two problems simultaneously: a surplus of small 3-room flats and growing demand for larger living spaces among the emerging middle class.

The solution was elegant. Families could purchase an adjoining 3-room flat next to their existing unit and legally merge them into a single property. The two separate title deeds were cancelled and replaced with one new title for what became classified as a “5-room Adjoined” or “Executive Adjoined” flat, depending on the total floor area.

The physical transformation was straightforward—knock down the partition wall between living rooms, cap one entrance, and suddenly you had a sprawling 140 to 160 square meter home. That’s nearly double the size of a standard 4-room flat, creating living spaces that are virtually impossible to find in today’s BTO launches.

These units attracted a specific demographic: multi-generational families who needed the space, affluent upgraders who wanted public housing luxury, and couples planning for their extended family’s future. In mature estates like Ang Mo Kio, Woodlands, and Yishun, these jumbo flats became quiet status symbols.

By 2022, only five 5-room adjoined units and two Executive Apartments remained in Blocks 562-565. They represented less than 2% of the 606 affected households, but their economic impact on the SERS exercise would be disproportionately significant.

The Valuation Verdict: Single Entity, Premium Price

Here’s what happened: The government valued these converted flats as single premium entities, not as two separate 3-room units.

This distinction wasn’t just semantic—it was economically transformative. When HDB’s professional valuers assessed these properties in early 2022, they looked at transaction data for comparable jumbo flats in Ang Mo Kio, not the value of two unconverted 3-room units.

The math tells the story. A standard 3-room flat in those blocks received compensation estimates of $290,000 to $390,000, depending on size. If the government had valued a converted unit as two separate flats, the compensation would have been roughly $580,000 to $780,000 (essentially 2 × $340,000).

Instead, the single-entity approach recognized what the resale market already knew: jumbo flats command a scarcity premium. Market data from 2020-2021 showed adjoined units in Ang Mo Kio trading for $800,000 to over $900,000—well above the sum of their component parts. Buyers were willing to pay extra for something they simply couldn’t get anywhere else: massive HDB living space in a mature estate.

The initial compensation estimates for these units likely ranged from $780,000 to $840,000 for 5-room adjoined flats, and $850,000 to $910,000 for the larger Executive Apartments. Then came the November 2022 adjustment.

The 7.5% Game-Changer

Seven months after the initial announcement, HDB made an unusual move. On November 9, 2022, they announced that actual compensation would be approximately 7.5% higher than the April estimates. The government attributed this to continued property market appreciation and the generally well-maintained condition of the flats.

For standard 3-room owners, this meant an extra $25,000 to $30,000—welcome, but not life-changing. For jumbo flat owners, the adjustment added $60,000 to $70,000 to already substantial payouts.

The final compensation packages for the seven households likely reached $838,500 to $903,000 for 5-room units, and $913,750 to $978,250 for Executive Apartments. Including removal allowances and reasonable expenses, some owners walked away with packages approaching the psychologically significant $1 million mark.

To put this in perspective: while their neighbors in standard 3-room flats received enough money to barely afford a similar replacement unit, these seven families held nearly triple that liquidity.

The Problem: Nowhere to Go

But here’s the cruel irony. Despite receiving nearly triple the compensation, these owners faced a spatial crisis that their less-compensated neighbors in standard units didn’t encounter.

The designated SERS replacement site, Pine Ville @ AMK, was designed with efficiency in mind. The unit mix topped out at 4-room flats—the largest measuring just 93 square meters. There were no 5-room, Executive, or 3-Generation flats planned or built.

For someone living in 140 to 160 square meters, downsizing to 93 square meters meant losing 33% to 42% of their living space. Imagine a multi-generational family that had spent decades in a spacious home, suddenly forced to cram into a unit smaller than most new condominiums.

The “Pine Ville Gap,” as residents came to call it, created a paradox: the government acknowledged these units were worth nearly $1 million, but the replacement site couldn’t accommodate anything close to their original size.

Three Paths Forward

Faced with this mismatch, the seven households had three strategic options, each with radically different outcomes.

Option 1: Cash Out at Pine Ville

The financially optimal move for some was to embrace the downsize. Buy the largest 4-room flat at Pine Ville for approximately $560,000, spend $60,000 on renovations, and pocket a surplus of around $280,000.

For elderly couples no longer needing massive space, this was actually attractive. They’d get a brand new flat with a fresh 99-year lease, proximity to the future Cross Island Line MRT stations, and a six-figure nest egg for retirement. Plus, Pine Ville units came with standard 5-year Minimum Occupation Period rules and no resale restrictions—making them more valuable than the newer “Plus” model BTOs being launched nearby.

Option 2: The Central Weave Lifeline

For families determined to maintain their living space, HDB offered a strategic escape hatch: 10% priority allocation in concurrent BTO exercises. The August 2022 launch included Central Weave @ AMK, a premium project in the heart of Ang Mo Kio Town Centre.

Central Weave was everything Pine Ville wasn’t. Located just six minutes from Ang Mo Kio MRT, it offered 5-room (113 sqm) and 3-Generation (120 sqm) units—not quite as large as the original jumbo flats, but far more acceptable than Pine Ville’s 93 sqm maximum.

The catch? These units cost $720,000 to $877,000. For regular Singaporeans, that price point combined with 16-to-1 application rates made Central Weave nearly impossible to secure.

But for SERS jumbo owners with $900,000+ in compensation and priority allocation rights, Central Weave became the perfect solution. They could upgrade to a trophy asset in a prime mature estate location, breaking even or walking away with a small surplus while maintaining reasonable living space.

Based on application data showing 85 SERS households applied for Central Weave, it is probable that some jumbo flat owners also considered this option, despite the reduction in space.

Option 3: The Resale Market Exit

A third path was to sell the SERS benefits on the open market and buy a resale jumbo flat elsewhere. With compensation around $880,000, an owner could purchase a similar Executive Maisonette in Yishun or Woodlands and maintain their 150+ square meter lifestyle.

The tradeoff? They’d sacrifice the fresh 99-year lease and the massive capital appreciation potential that comes with new BTOs in mature estates.

The Tale of Two SERS Experiences

By January 2026, as Pine Ville nears completion at 75% construction progress, we can now fully appreciate the divergent outcomes within this single SERS exercise.

Standard 3-room owners received approximately $350,000—just enough to cover a replacement 3-room flat at Pine Ville with minimal surplus. Many expressed anxiety about renovation costs and the financial pressure of maintaining their lifestyle.

The seven jumbo flat owners, in stark contrast, enjoyed $50,000 to $340,000 in surplus depending on their choice. More importantly, they had agency: the power to choose between cashing out, upgrading to Central Weave, or exiting to the resale market.

This wasn’t accidental inequality—it was the mathematical result of market-based valuation applied to heterogeneous assets. The government treated everyone “fairly” by using market value, but market value itself reflects deep disparities in asset worth.

What This Means for Future SERS

The Ang Mo Kio SERS exercise may be one of the final chapters in SERS history – The Last SERS In Singapore. In August 2025, HDB announced no plans for additional SERS sites, pivoting instead to the Voluntary Early Redevelopment Scheme (VERS).

The treatment of adjoined flats reveals a quiet policy position: the government will compensate fairly for legacy anomalies, but won’t reproduce them. By offering only standard 4-room units at Pine Ville, HDB effectively “right-sized” the housing stock, converting low-density jumbo units into higher-density standard configurations.

For the seven families, the compensation gave them the financial means to find space elsewhere—but the state has no obligation to directly replace what it’s phasing out.

The Bottom Line

The million-dollar question had a clear answer: adjoined flats were valued as single premium entities, resulting in compensation packages approaching $1 million for the largest units.

This valuation approach acknowledged market reality and treated these unique assets fairly on paper. But it also exposed a structural tension in SERS: what happens when the market value of an old flat far exceeds the cost of its designated replacement?

For 599 households in those Ang Mo Kio blocks, SERS was a stressful but manageable transition. For seven households, it was something else entirely—a once-in-a-lifetime windfall that turned aging jumbo flats into either substantial cash or premium new assets in Singapore’s most competitive housing market.

As Pine Ville @ AMK rises toward its 2027 completion, those who chose Central Weave are watching their unbuilt flats appreciate in value—possibly earning more annually than many Singaporeans make working. Those who cashed out at Pine Ville are sitting on six-figure nest eggs. And those who exited to resale markets retained their spatial luxury.

In the end, the government’s decision to value these flats as single entities didn’t just answer a technical question—it created a small cohort of SERS winners who experienced public housing renewal in a fundamentally different way than their neighbors.

And that, perhaps, is the real story of the Ang Mo Kio SERS exercise.

Disclaimer

Important Notice: This article is based on analysis of publicly available information, market data, and policy documents related to the Ang Mo Kio SERS exercise announced in April 2022. The compensation figures, valuations, and financial outcomes presented are estimates and reconstructions derived from market transactions, official percentage adjustments, and analytical modeling—not confirmed actual payouts to individual households.

Key Limitations:

- Privacy Protection: HDB does not publicly disclose individual compensation amounts. The figures presented for the seven adjoined units are reasonable estimates based on market comparables, official percentage adjustments (+7.5%), and established valuation methodologies.

- Not Financial Advice: This article is for informational and educational purposes only. It should not be construed as financial, legal, or property investment advice. Readers considering SERS options, property transactions, or housing decisions should consult qualified professionals.

- Simplified Scenarios: The three strategic options presented are illustrative examples. Actual household decisions involved complex personal circumstances, family needs, financial positions, and preferences not captured in these generalized scenarios.

- Market Volatility: Property values, BTO prices, and resale market conditions cited reflect specific time periods (2020-2026) and may not represent current or future market conditions.

- Policy Evolution: SERS policies, HDB regulations, and housing schemes continue to evolve. Information accurate at the time of the 2022 exercise may not apply to future redevelopment schemes or current housing policies.

No Endorsement: This article does not represent the views of HDB, the Singapore government, or any official agency. Any errors in interpretation or analysis are solely those of the author.

Individual Circumstances Vary: Actual compensation received by residents depended on numerous factors including exact flat size, condition, floor level, location within the block, and professional valuation at the time of assessment.

Readers are encouraged to verify all information with official sources and seek professional advice for their specific situations.