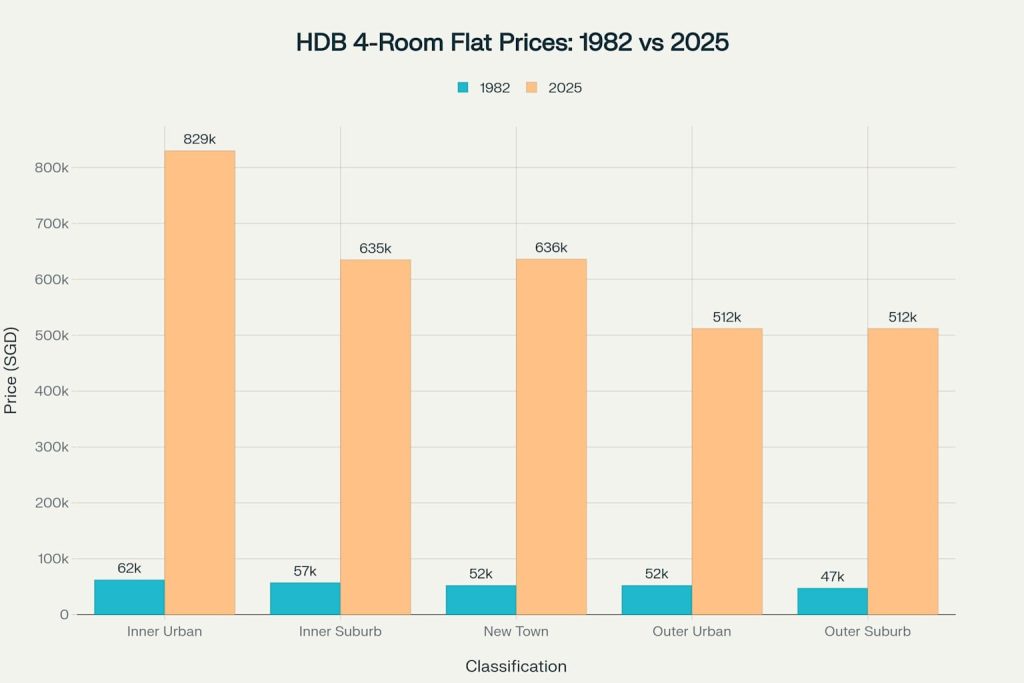

In 1982, when your parents might have been your age, buying a brand-new 4-room HDB flat in places like Jurong West cost around $47,500. Fast forward to 2025, and that same type of flat now costs over $500,000. But that’s nothing compared to The Peak @ Toa Payoh, where 5-room flats are selling for a record-breaking $1.6 million. How did we get here, and what does this mean for young Singaporeans today?

The 1982 Classification System: A Different Singapore

Back in 1982, Singapore’s Housing and Development Board (HDB) organized all public housing into five distinct categories that shaped where and how people lived. This wasn’t just administrative paperwork—it was a strategic plan that directly influenced flat prices and determined which areas would become today’s million-dollar hotspots.

Inner Urban: The Premium Pioneer

These were the most expensive flats in 1982, located in central areas like Chinatown and Tanjong Pagar. A 4-room flat in places like Rowell Road cost around $62,500 in 1982. Today, that same flat commands $829,999—more than 13 times the original price.

Inner Suburban: The Sweet Spot

Areas like Holland Avenue, Queenstown, and Kallang/Whampoa offered the perfect balance between location and affordability. In 1982, a 4-room flat here cost about $57,500. Today, these mature estates are among the most sought-after, with Holland Avenue flats selling for $635,000.

New Towns: The Planned Communities

Ang Mo Kio, Clementi, Bedok, and Toa Payoh were Singapore’s showcase new towns in 1982. These estates introduced innovative housing types, including the first executive maisonettes. A 4-room flat cost around $52,500 in 1982, and today similar units average $636,259.

Outer Urban and Outer Suburban: The Frontier

Places like Jurong East, Jurong West, Woodlands, and Hougang were considered the frontier of urban development. With 4-room flats priced from $47,500 to $52,500 in 1982, these areas offered the most affordable homeownership options.

Today’s Million-Dollar Reality: Where the Money Goes

The transformation has been dramatic. As of 2025, there are now million-dollar HDB flats in 23 estates, up from just 17 estates two years ago. In Q1 2025 alone, 348 flats crossed the million-dollar mark—the highest quarterly number ever recorded.

The New Luxury Leaders

The Peak @ Toa Payoh has become synonymous with expensive HDB living. This DBSS (Design, Build and Sell Scheme) project regularly sees 5-room flats selling between $1.3 million to $1.6 million. What makes it special? Location, build quality, and the fact that these units were originally sold for just $539,000 to $722,000 when launched.

Kallang/Whampoa leads Singapore with 110 million-dollar transactions, followed by Bukit Merah with 95 transactions and Toa Payoh with 84. These aren’t just isolated cases—they represent entire neighborhoods where HDB flats routinely sell for seven figures.

What Young Buyers Can Still Afford in 2025

Don’t despair—affordable options still exist, though they require strategic thinking about location and flat type.

The Budget-Friendly Champions Jurong West remains one of Singapore’s most affordable major towns. In 2025, you can still find:

- 3-room flats: $245,000 – $585,000

- 4-room flats: $385,000 – $780,000

- 5-room flats: $415,000 – $952,888

Woodlands offers excellent value for young families willing to live near the Causeway. Current prices range from $450,000 to $550,000 for 4-room flats, making it significantly more affordable than central areas.

Punggol provides a unique water-facing lifestyle with relatively reasonable prices. 5-room flats range from $630,000 to $950,000 depending on the exact location and block age. The newer Sumang Walk area commands premium prices around $840,000 for 5-room flats, while older Edgefield Plains units start from $630,000.

The Emerging Areas to Watch

Sengkang, Bukit Panjang, and even Yishun have recorded their first million-dollar transactions. These areas represent the next wave of price appreciation, offering current affordability with future growth potential.

The Mathematics of Housing Inflation

The price increases since 1982 far exceed normal inflation. If HDB prices had simply followed Singapore’s average inflation rate of about 3% annually, a $47,500 flat from 1982 should cost around $164,000 today. Instead, the average increase has been 10-13 times the original price.

This means HDB prices have grown approximately 3-4 times faster than general inflation. Several factors explain this dramatic appreciation:

- Land scarcity: Singapore’s limited land supply creates natural price pressure

- Population growth: Demand consistently outstrips supply

- Economic development: Rising incomes enable higher prices

- Locational premiums: Central areas command increasing premiums

Smart Strategies for Today’s Young Buyers

Consider the New Classifications While the official 1982 classifications no longer exist, understanding the principles helps identify opportunities:

- Target “New Towns” of today: Tengah, Bidadari, and newer Punggol phases offer modern amenities at relatively reasonable prices

- Look beyond mature estates: Woodlands, Yishun, and Jurong West provide excellent connectivity and amenities without the mature estate premium

- Consider resale vs. BTO: Current BTO prices in non-mature estates range from $300,000-$400,000 for 4-room flats, while resale flats offer immediate availability at higher prices

Timing the Market

The government has implemented cooling measures including reducing the loan-to-value ratio from 80% to 75% for HDB loans. Additionally, more BTO flats are expected to reach their Minimum Occupation Period (MOP) from 2026 onwards, potentially increasing supply and moderating prices.

The Future Outlook: What to Expect

Experts predict HDB resale prices will continue growing at 4-6% annually in 2025, slower than the 9.7% growth in 2024. The government may also review the 15-month wait-out period for private property owners when prices begin to moderate.

For young Singaporeans, the key is understanding that while prices have increased dramatically since 1982, homeownership remains achievable with proper planning. The areas your parents might have considered “ulu” (remote) in the 1980s—like Jurong West, Woodlands, and Punggol—now offer excellent connectivity, amenities, and community life.

The 1982 classification system’s legacy lives on: location still matters, but today’s “Outer Suburban” areas often provide the best value proposition for young buyers starting their homeownership journey. The $47,500 flat of 1982 may be history, but the dream of affordable public housing continues, just with more zeros attached to the price tag.