To Top UP Or Not To Top Up

As we sail through the financial seas of life, the recent closure of the CPF Special Account (SA) at age 55 has stirred waves of contemplation. Our original goal—to achieve $1M at age 65 and employ the SA Shielding strategy—was twofold: to fund our golden years and to act as a buffer for unforeseen medical expenses alongside CPF Life payouts. But alas, the closing of the SA has cast a spotlight on an intriguing phenomenon: policy risk

1. The SA Closure and the Enhanced Retirement Sum (ERS)

The SA Shielding Hack: A Fond Memory For Those Aged 55 and Above

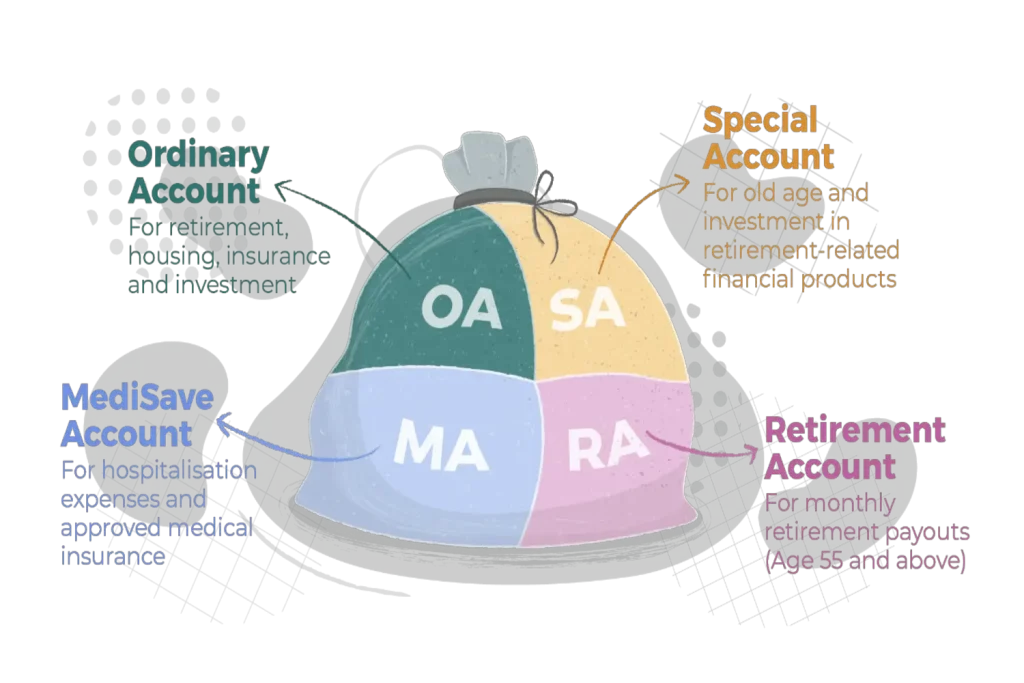

In the good old days, the CPF-SA Shielding Hack was our secret weapon. At age 55, we could maintain a risk-free SA with an attractive 4% annual interest rate. And the cherry on top? We could withdraw from it anytime. This strategic maneuver allowed us to avoid transferring SA funds into the Retirement Account (RA), ensuring that most of our RA funds came from the Ordinary Account (OA).

2. The New Reality: ERS and Policy Control

However, the winds of change have blown our beloved hack away. The government will be closing the SA at age 55 in 2025, discontinuing our CPF-SA Shielding escapades. But fear not! They’ve introduced the Enhanced Retirement Sum (ERS), set at 4 times the Basic Retirement Sum (BRS). Stability beckons, but so does the lock-in effect—half a million locked up, subject to policy decisions.

Unlike SA which I saved up and can choose to withdraw any time after 55 after meeting FRS, the decision to put half a million into my ERS which only THE policy maker have full control over it makes me uncomfortable.

3. Medical Expenses and the ERS

Life after 65, unforeseen medical illness or needs in life can happened anytime. Say if one fine day my short-term monthly medical fee exceeds my CPF Life monthly maxed pay-out, can I request more sum to be disperse to me from my CPF? Maybe after some email appeals I may eventually get entertained. But on the sick bed most likely I will be pondering on the initial decision of putting half a million in ERS just for the sake of the 4.08% and just when I needed it most, it is as good as illiquid. Another consideration is currently we can switch between Standard to Enhanced sums to have more pay-outs to meet certain needs. But again, this decision solely depends on the Policy Maker. There is no guarantee the goal post will not be shift again for the ‘greater good’ of all Singaporeans. Therefore, if I am CPF rich and financial savvy, I will continue to exercise and keep my body mind healthy and young, consistently invest and save for long term. Lastly keep the bare minimum in CPF.