On 30th August 2022 at 10am, HDB finally opened the portal for the AUG 2022 BTO.

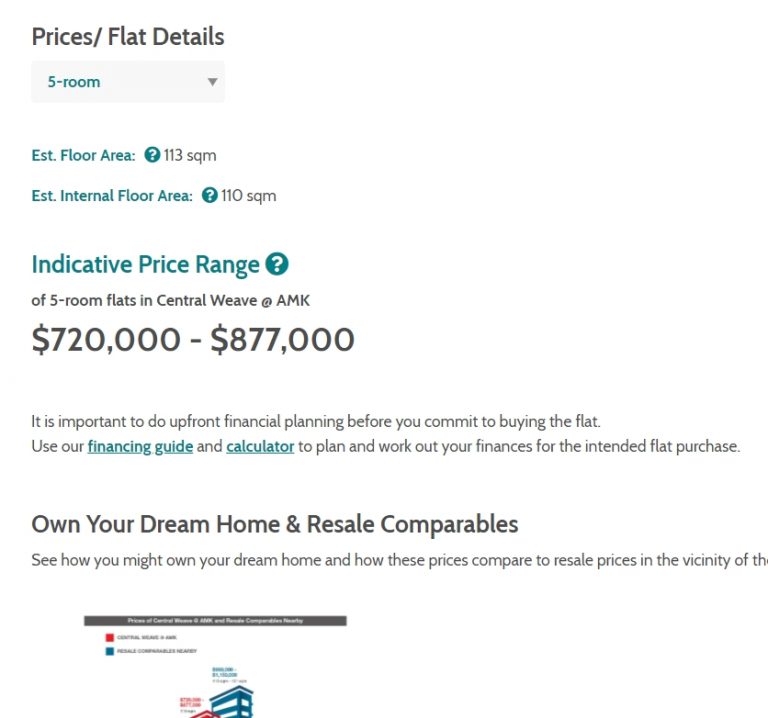

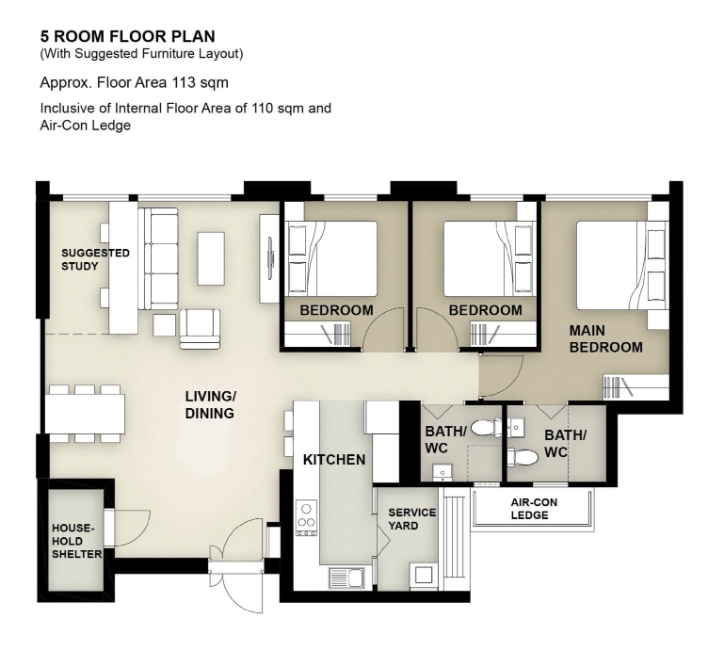

Pricing and number of 4-rooms and 5-rooms at Central Weave @ AMK was the #1 priority in everyone’s mind.

Holy cow! A 4-room is priced between $535K – $676K while a 5-room is priced between $720K – $877K!

HDB really needs to change its vision and mission statement – “We develop public housing to provide Singaporeans with affordable, quality homes, and a better living environment.”

A few of my friends thought the price tag of half a million was for a resale flat. I had to show them the HDB Portal in order to convince them that it is the price of a new 99-yr 4-room HDB floor.

Everyone can own a $500K 99-yr 4-room HDB at ease; and then just to watch its half a million-price tag reduced by 20% when it is left with 60-yrs of remaining lease.

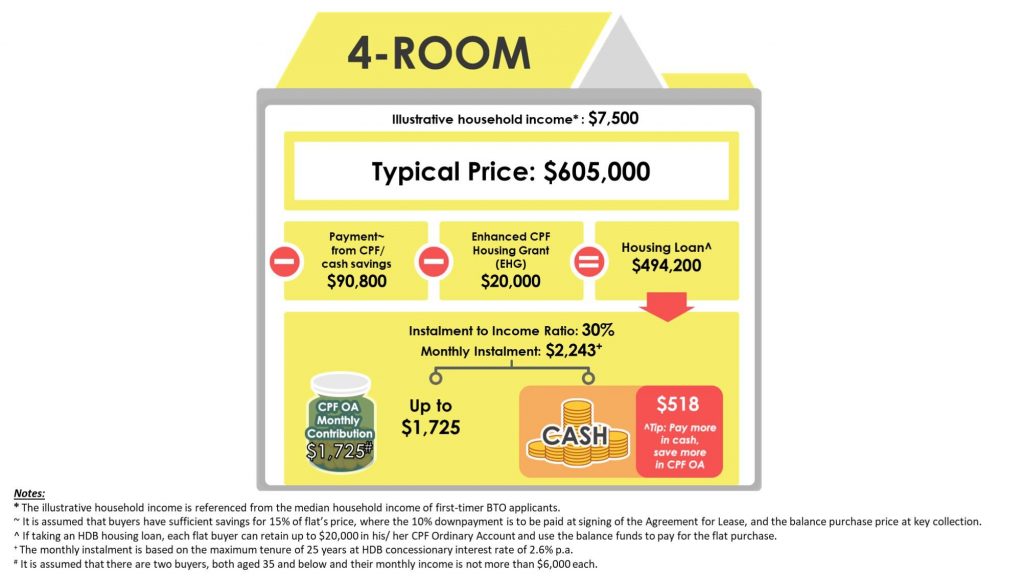

Nice illustration. But it also means both husband and wife cannot lose their current jobs or suffer a pay cut.

As usual, the authority painted such a nice ‘affordability’ picture of our dream home.

With a median household income of $7,500 and through various CPF / cash savings, grant and loan, the couple will be able to afford a 99-yr $650K 4-room HDB. Is it too good to be true?

Let’s work out some estimates.

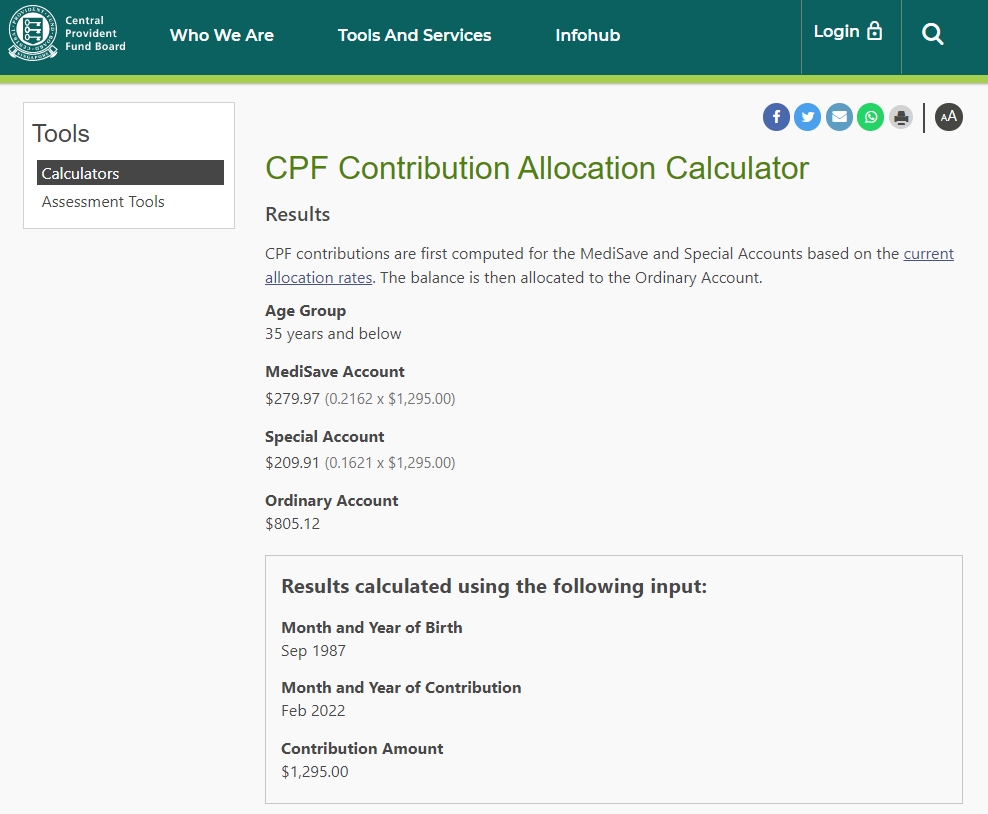

He and she are both 35 years old and each drawing a salary of $3,500. They have no kids and recently bought a new 99-yr 4-room BTO that set them back for $650,000 and on a 25-yr tenure.

Assuming he had to serve National Service and thereafter went for his 2-yr degree. After graduation, he’s 25-yrs old and only has worked for 7 years. She on the other hand had worked for 9 years. Combined CPF OA of both will be approximately $74,744 + $98,583 = $173,327.

Supposedly he and she will need to retain $20,000 in each of their CPF, the usable amount will therefore be approximately $54,744 + $78,583 = $133,327.

So typical household gross income of $7,000, $650,000 – $133,327 from CPF saving – $20K housing grant = $496,673

Assuming the loan amount will be $496,673 and maximum tenure of 25 years at HDB concessionary interest rate of 2.60% p.a.

An estimated monthly payment for the above tenure will be $2,253.25.

However, as we can see from their month CPF OA contribution, the combined amount is $1,610.24. There will be a shortfall of $643 which the couple will need to each top up $322 each month.

My Math is no good so the above figures is just an agaration. But it doesn’t look anywhere near affordability to me.

Considering the $650K has yet to factor in renovation which are in the range of tens of thousands of dollar. Don’t forget the 7% inflation rate (4% core inflation) as well as the 9% GST hike from our kind and caring government.

I guess that may help to explain why people are all selling their 99-yr old flat immediately after the MOP period.

That’s the fastest way to earn a 5 to 6 figures profit without incurring any penalty as well as to stop the monthly cash bleed.

So who ends up the biggest sucker in this game? Of course will be your Primary school kids. When their time come to own a new 99-yr BTO HDB, a 4-room or 5-room might already be over a million dollar. And prices of MOP resale flats will be completed out of reach for them.